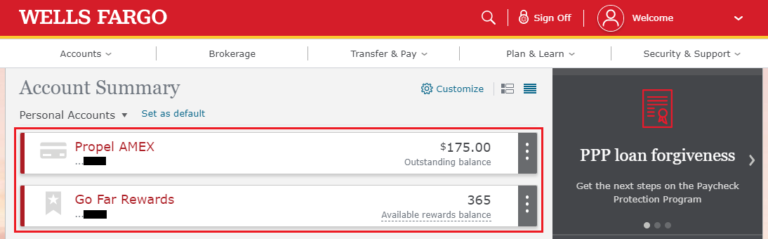

Multiple Indian banks render different varieties of mortgage issues to a great number of hopeless people in Asia. If you have currently taken a consumer loan on the internet or offline off another bank, don’t get worried about it. You could import the remaining equilibrium of one’s present personal loan into the Axis Financial in some procedures. This really is a best ways to disappear the degree of attention applied to the borrowed funds you may have borrowed. In addition, you could potentially easily settle the borrowed funds and also have reduce an extremely important financial liability prior to its months.

Financing For some Objectives

We are in need of money to meet up with numerous criteria in our lives. There was a time when banks familiar with ask mind-blowing inquiries in order to individuals regarding your use of lent money. Nowadays, the brand new character of borrowing studying features changed a lot in the Asia. Now, of a lot Indians don’t hesitate to bring fund to meet up with the newest a lot of time-awaited hopes for its lifetime. Begin with Axis Bank any moment and you will receive a great loan of Rs 50,000 so you can fifteen lakhs in order to satisfy almost all crucial requires. Its a lot better than asking Kansas loans having financial help out of somebody.

Comfortable Mortgage Fees Period

Mortgage payment is an essential accountability for your individuals and therefore they can not prevent regardless. Axis Lender gives you Small signature loans for you to five years. To repay the brand new lent money conveniently, divide the latest EMI installment payments centered on your revenue and you will expenditures. Upcoming, consult the newest banker to activate automated repayment on the savings account. Which liberates you against the duty of going to your bank’s nearest part to have financing fees every month. The lending company instantly deducts the brand new payment number that have applicable costs and you may notifies you of the identical.

100 % free Visit For everybody Users

Axis Lender executives are always willing to answr fully your issues and you can concerns of unsecured loans. You can purchase details concerning financing towards their webpages. Request the professionals in order to describe your doubts concerning mortgage and you can grab an appropriate decision( regarding providing a loan) accordingly.

Before applying getting Axis Financial on the web unsecured loan, it’s important to have a look at regardless if you are a complement candidate to have they or perhaps not. The lending company enjoys remaining the mortgage qualification criteria simple. Permits of many Indians to try their fortune and also have the newest requisite financing throughout economic issues. You ought to fulfill the adopting the qualification standards to apply for the mortgage-

- Indian citizenship,

- Age-21-60,

- Steady employment which have state government, main bodies, societal business enterprises, or any other acknowledged organization providers,

- Minimal month-to-month income- Rs. fifteen,000.

- A working checking account.

Precisely what does Axis Financial Assume Out of Applicants?

Annually, multiple mil Indians apply for unsecured loans. However, not all of those efficiently obtain the wished currency. It’s never very easy to rating Axis Financial instant personal loans in the event that there’s absolutely no planning on borrower’s front. Are you ready to submit your application to your banker? Have you got all of the data needed for the loan? Do you have sufficient understanding of the mortgage?

Accuracy off Supplied Suggestions

Its tricky for the financial to go through the huge number of data out of numerous software, sort them away and you can process applications. If your level of apps is quite higher, bank professionals will not irritate to mention you and demand a the fresh app into the correct info. Part of the motto out of Axis Financial would be to question money to help you the eligible candidates as quickly as possible. So, this may rescind applications that have wrong suggestions or shed factors. While trying to get the borrowed funds, consider all sections of the application form. Fill in all of the facts meticulously to check out if they are right or not. Upcoming, result in the needed transform and look the program once more. Bank executives can very quickly ensure your data and you can procedure the applying further as opposed to placing it on the pending listing.