Another type of example, into an excellent $300,000 household

Average homebuyers will likely enjoys a loan equilibrium inside the the new $3 hundred,000 variety. In this situation, within seven.5% towards a lately unsealed mortgage, attention could cost throughout the $20,000.

Which amount, itself, wouldn’t exceed the high quality deduction to own a married couples. It might meet or exceed the quality deduction for someone who has got filing personally, yet not.

How do you understand certainly?

These circumstances are created to leave you a concept how much brand new homebuyers spend when you look at the attention. Keep in mind the real count your paid in appeal are novel for you.

What’s promising: You can see. Just look at the 1098 function from your own lender. For individuals who spend their homeloan payment on the internet, you might probably get the function in your account.

If your number your paid in focus exceeds your simple deduction, you might save money because of the composing away from your attract costs.

Discuss with a taxation elite group

By the nature, tax rules is tricky, especially when you start itemizing the write-offs. In case your interest rarely exceeds your practical deduction, you will possibly not save yourself enough to justify the excess some time bills out of itemizing.

Naturally, if for example the appeal is only one of a lot deductions, contrast the joint deductions for the important deduction to see whether its useful to help you itemize.

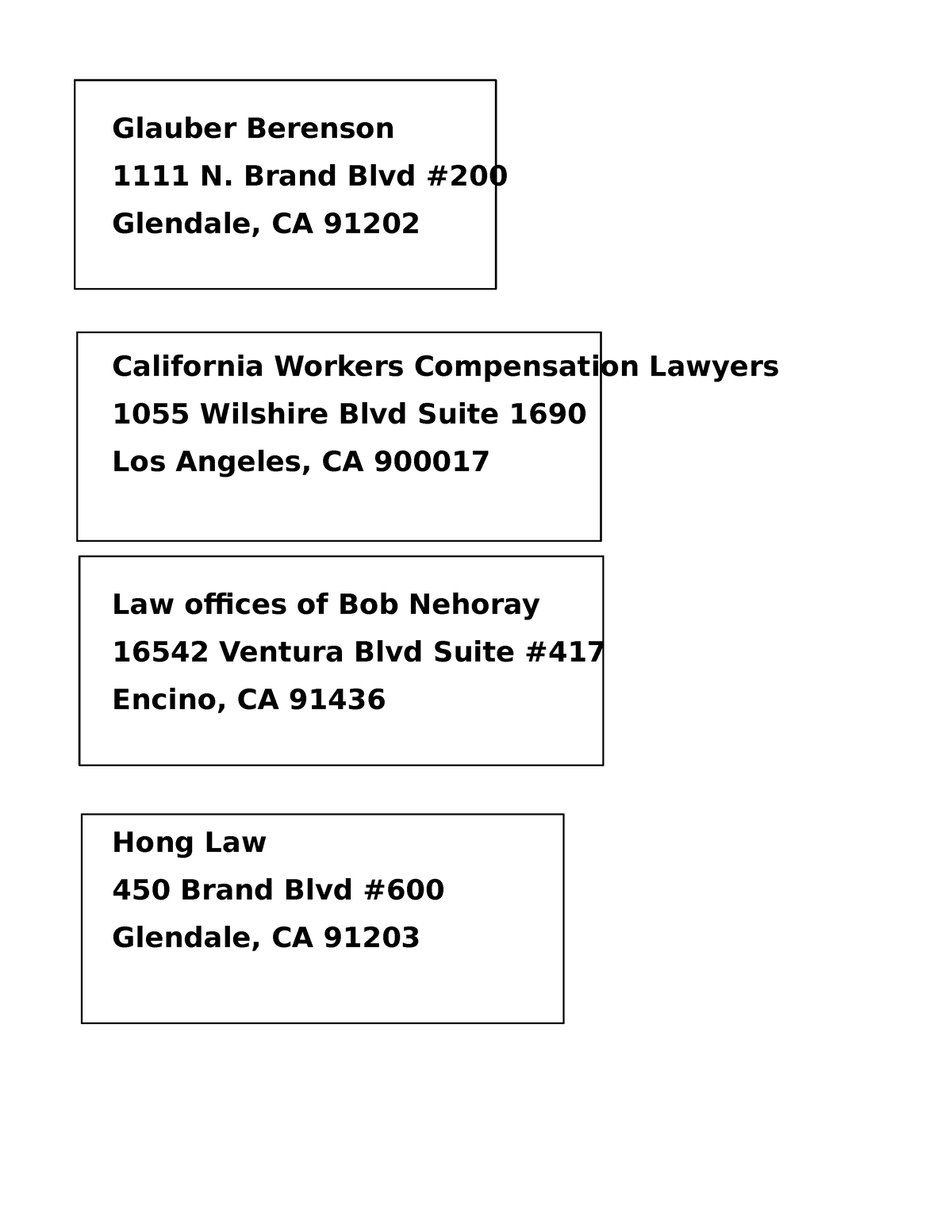

This short article must not be used while the tax information – exactly as standard recommendations. Seek advice from a tax elite group if you’re nevertheless unclear whether its worthwhile to type away from the financial focus to have 2022.

Composing out of financial attract is one of prominent means for home buyers to lessen its tax expense. Homeownership has many almost every other tax benefits, as well.

Home office write-offs

While you are notice-working, or a business owner, and you also use section of your residence as the property office, you can write off your property workplace expenses, cutting your taxable money.

Renters will perform so it, too. In order to be considered, you’ll need a gap at your home your playing with only getting providers, and you might need to record men and women expenses.

Financial support increases exceptions

For individuals who offer most of your domestic, otherwise number one home, avoid being responsible for the full money development tax with the the transaction.

- When you are submitting alone, up to $250,000 in earnings about domestic selling was omitted from investment development

- Maried people is prohibit doing $five hundred,000 inside earnings from a property selling

If you lived in your house for two out from the previous 5 years, you could potentially qualify for so it difference.

Leasing possessions costs

Home owners which book the property can be write off repairs and product costs. Landlords should keep perfect details out-of rental income and costs.

Taxation loans

Specific metropolises and you may counties give income tax loans getting homeowners whom prefer to order in certain communities. For many who bought an alternate home in the 2022, check your city’s website to see if your qualify for an excellent tax borrowing.

Financial income tax deduction FAQ

You can’t subtract their full payment per month. You could deduct the part of they this link that goes to notice. At the start of your loan, a massive part of for every payment per month is actually desire. By the end, nearly nothing of it try. Focus payments slide continuously along side lifetime of your mortgage. Once again, you could merely get this to deduction for folks who itemize their write-offs.

Yes. Although not once the a lump sum. That have a thirty-year home loan, your deduct 1/30th of the cost of the latest issues on a yearly basis. Which have a beneficial 15-year financing, your deduct 1/fifteenth. And the like.

Zero. By 2022, personal home loan insurance premiums are no extended allowable. Congress alter tax legislation from time to time, so it is you can it deduction you are going to go back in the future income tax age.