When considering a house remodeling project, you have many choices and also make long before you hire an excellent specialist or like decorate colors. You will have to plan the range and you may finances of your own redesign, and then you have to determine the way to pay for they.

If you fund any project, you will want to investigate the many mortgage alternatives that are offered and select one that suits yours financial predicament. A couple an excellent loan brands to take on for household renovations is actually home collateral lines of credit (HELOC) and private money. Why don’t we go through the parallels and differences from a consumer loan versus. property guarantee personal line of credit.

How can HELOCs and private finance functions?

A house Guarantee Personal line of credit (HELOC) was a form of revolving borrowing from the bank which enables one to borrow resistant to the guarantee of your property. To get it another way, your own house’s equity try what is actually remaining after you deduct your financial harmony from the house’s value. The pace to your a beneficial HELOC is typically adjustable, tied to the prime rate, and will change over date.

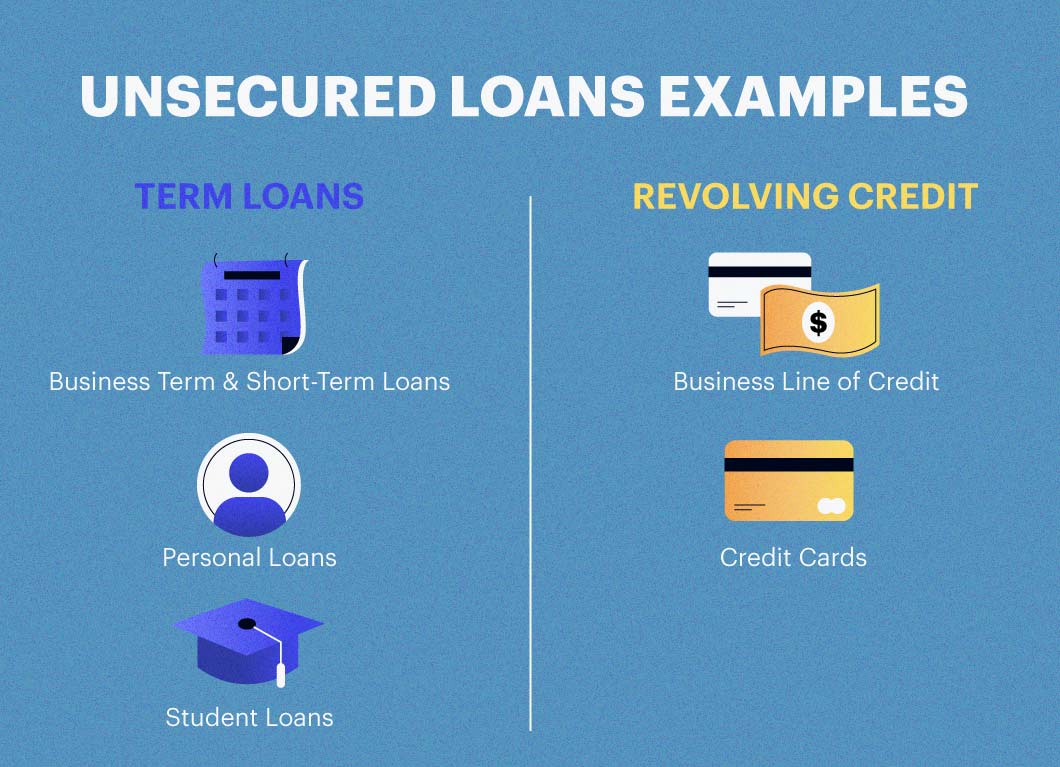

An unsecured loan, while doing so, try a consumer loan that isn’t linked with one guarantee. Unsecured loans have a fixed rate of interest, regular repayments and a set installment period, constantly you to five years.

Unsecured loans versus. HELOCs: Parallels

One another HELOCs and private funds need a credit check for acceptance, meaning that your credit score was one thing. The brand new standard borrowing certification criteria are generally a comparable, and you can both funds will eventually need you to pay dominant (balance) including attract to your currency you acquire.

Personal loans compared to. HELOCs: Distinctions

One of the largest differences when considering domestic collateral credit lines and personal fund is the ways the money are delivered. With a great HELOC, you can withdraw loans as much as their borrowing limit whenever you you prefer them using your draw months and you may spend notice only to the the total amount you removed otherwise utilized and you may borrow once more without having so you’re able to re-apply.

Personal loans make you your own financing in advance in one single lump share. You’ll then create fixed monthly premiums until the loan try paid back from.

Another huge difference is that unsecured loans normally have a top focus loan places Hissop speed since they are unsecured and you can involve greater risk into lender. As HELOCs are secured by guarantee of your home, its rates when you find yourself still adjustable may be a tiny all the way down.

Which financing is the best for building work expenditures?

If it is time and energy to prefer a financing option, the decision will be based on your own individual demands and the latest range of your own endeavor.

If you are not just yes in regards to the complete can cost you out-of a higher, ongoing restorations enterprise and want the flexibleness of attracting money as the you decide to go, an effective HELOC is the better option.

As well, a HELOC may have terminology up to twenty five years. HELOCs will let you give the expense more than a longer period of your energy. You will simply pay appeal to the portion of the range which you use, however, just like the interest toward good HELOC try changeable, your monthly premiums will get improve in the event that rates rise or if perhaps you create even more brings.

A personal loan may make a lot more feel when you have a good one-big date expense that have a definite costs, including substitution ageing screen having energy saving ones otherwise strengthening yet another deck. Signature loans give you the stability of a fixed interest rate and you may a flat payment several months, which is useful whenever making plans for your funds. Signature loans in addition to generally have a more quickly application and you will approval processes compared to an effective HELOC, and is a bit more advanced.