The definition of, or timeframe you must repay an unsecured loan, is usually on the a few in order to 5 years. This can be far reduced versus cost title having home financing, and is multiple years long. This is why you have a shorter time to repay your personal bank loan, which will make the monthly premiums higher.

Interest levels

Unsecured unsecured loans might have highest interest levels than just secured loans while there is zero security to the bank to seize in the event the you standard on financing. Because financial are using up a great deal more exposure by financing so you’re able to you which have an enthusiastic unsecured consumer loan, they’ll basically fees a great deal more from inside the desire.

You’ll also have probably in order to satisfy the absolute minimum money and you will borrowing from the bank rating to get approved to own a personal loan. Specific loan providers do give an unsecured loan to own lower income , however, these types of loan may have a higher interest.

Unsecured loans are used for any kind of purpose, also financial support a cellular home if not since loans having household update . It flexibility ensures that purchasing a mobile house with a personal mortgage makes feel to you. https://paydayloanalabama.com/oneonta/ Although not, when your were created domestic qualifies as real estate – definition it is into the a charity, doesn’t have rims, while own new homes below it – you’re better off together with other resource alternatives.

In case your mobile home fits the expression property, you could potentially make an application for home financing with traditional home loan apps, instance Federal national mortgage association or Freddie Mac computer, or department-backed financial apps, like those on the Federal Houses Management (FHA), the newest You.S. Agencies regarding Experts Situations, or the You.S. Service regarding Agriculture.

An alternative funding solution you could search for a cellular home is a great chattel mortgage. This is a variety of private property financing which may be employed for movable assets, particularly in the event the cellular home is based in a produced house community while rent the house the mobile is on. The borrowed funds does not include the brand new house, and so the closing techniques is easier and less costly than just it has been a traditional home loan. Yet not, chattel loans are usually to possess smaller amounts of money than mortgages is, and they have shorter cost conditions. This means the interest pricing into the chattel funds are usually large, that will lead to large month-to-month mortgage costs.

Delivering an unsecured loan to possess a cellular Family

If you’ve felt like an unsecured loan is the right selection for your own mobile home purchase, there are a few steps in the process. Some tips about what to accomplish.

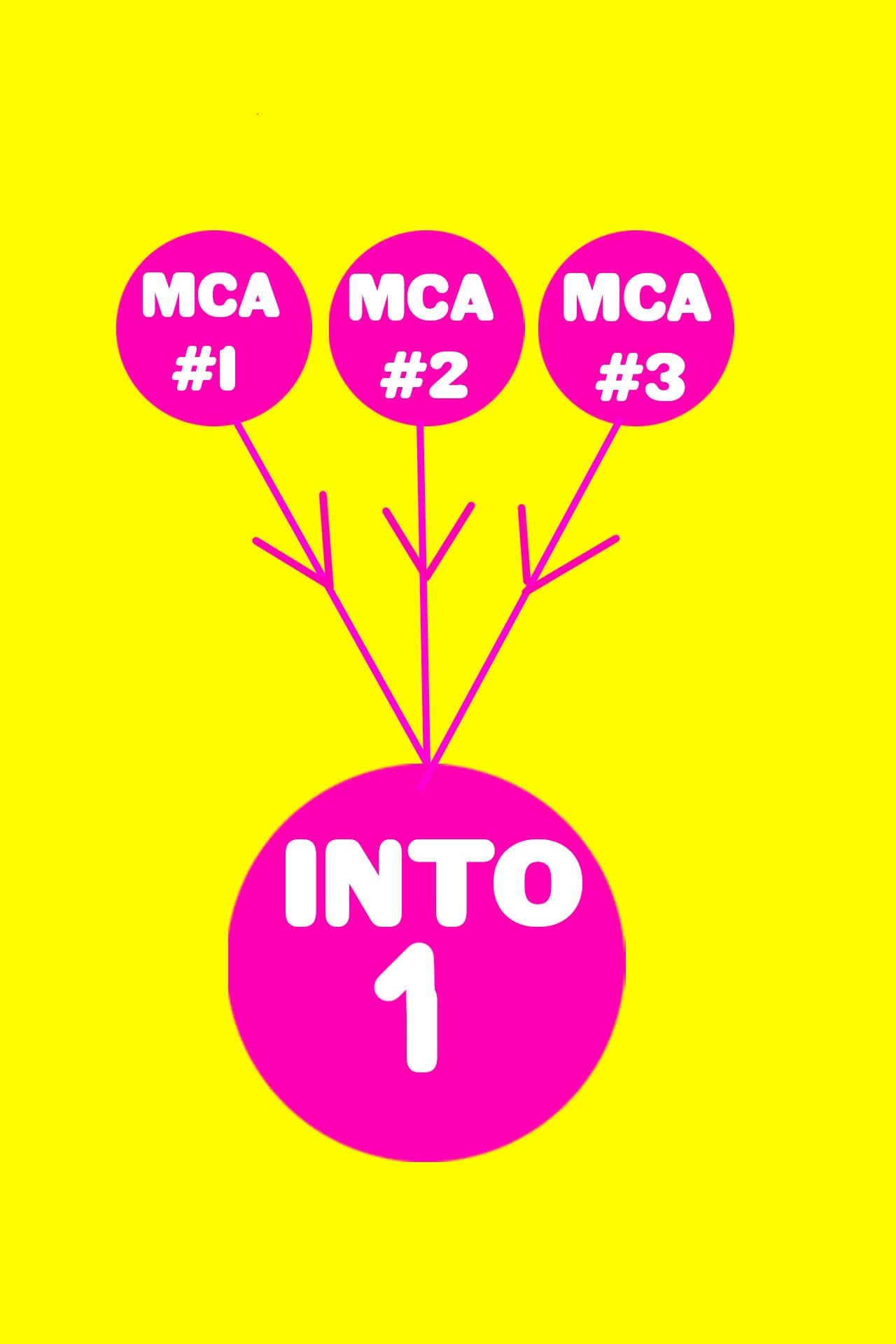

1pare Lenders

When shopping for a personal bank loan getting a cellular family, you will want to contrast loan providers to see what rates and terms and conditions it you’ll promote. You could potentially mention alternatives out of financial institutions and you can borrowing from the bank unions, as well as those of on the web lenders. Whenever choosing an online lender, watch out for one warning flags one to code the lending company may well not feel reliable. Look out for such things as unrealistic pledges, inaccuracies from the loan small print, and you will requests initial application charge.

dos. Pertain On line

Once you select a loan provider, you might apply for a personal loan . Using online is the fastest and simplest way. As you become come, be aware that there are certain unsecured loan standards you will have to satisfy. For-instance, you are going to need to fill out an application and supply several files, such evidence of earnings, employment, and you will title. Gather these types of data ahead of time and also have them ready.

step 3. Discovered Finance

Just after you may be approved getting an unsecured loan, you’ll get the money from inside the a lump sum payment, always inside a few days. Some loan providers even bring exact same-date funding. You will then pay back the cash you borrowed having attention throughout the years into the monthly premiums.