Detailing that it’s rare locate new’ sorts of mortgages regarding the article-drama You.S. home loan money markets, Citi Around the world Perspectives & Solutions’ (GPS) Home for the future declaration asserted that a beneficial the newest crypto- adjoining mortgage product keeps achieved stature with an easy desire: Enabling crypto traders to utilize their capital progress so you can safe good loan without taking on money increases income tax liability by the selling cryptocurrency to pay for possessions, and you will instead separating towards digital possessions of numerous high crypto owners promise tend to increase dramatically in well worth across the continuous.

The way in which this type of mortgage loans tasks are very much like the means decentralized fund (DeFi) lending/borrowing from the bank platforms work: Install crypto because the equity to the mortgage – whether that is stablecoins into the DeFi otherwise a mortgage regarding construction business.

Among pros regarding financial market is that people exactly who live away from crypto financial investments are locked off Federal national mortgage association and you may Freddie Mac computer – that is to say, secured from the conventional financial credit business.

You to differences would be the fact Citi found that mortgage loans generally want crypto deposits about equal to the cost become moved to your a great custodial membership, while you are DeFi lenders generally need anywhere between 125% and 150% guarantee so you’re able to account.

Mortgages tend to have margin calls to prevent liquidation – and you https://paydayloanflorida.net/chipley/ will potentially property foreclosure – if the collateral’s value falls below a particular range, say 35% of the loan’s worth, whereas DeFi fund basically liquidate if the value ways a full property value the loan.

A comparable principle will be put on secured loans by plenty of centralized crypto credit organizations, together with Sodium Financing ($5,000 minimum) and you will Unchained Investment ($ten,000 minimal), and this as opposed to various other user-up against crypto loan providers, promote dollars financing in place of stablecoins.

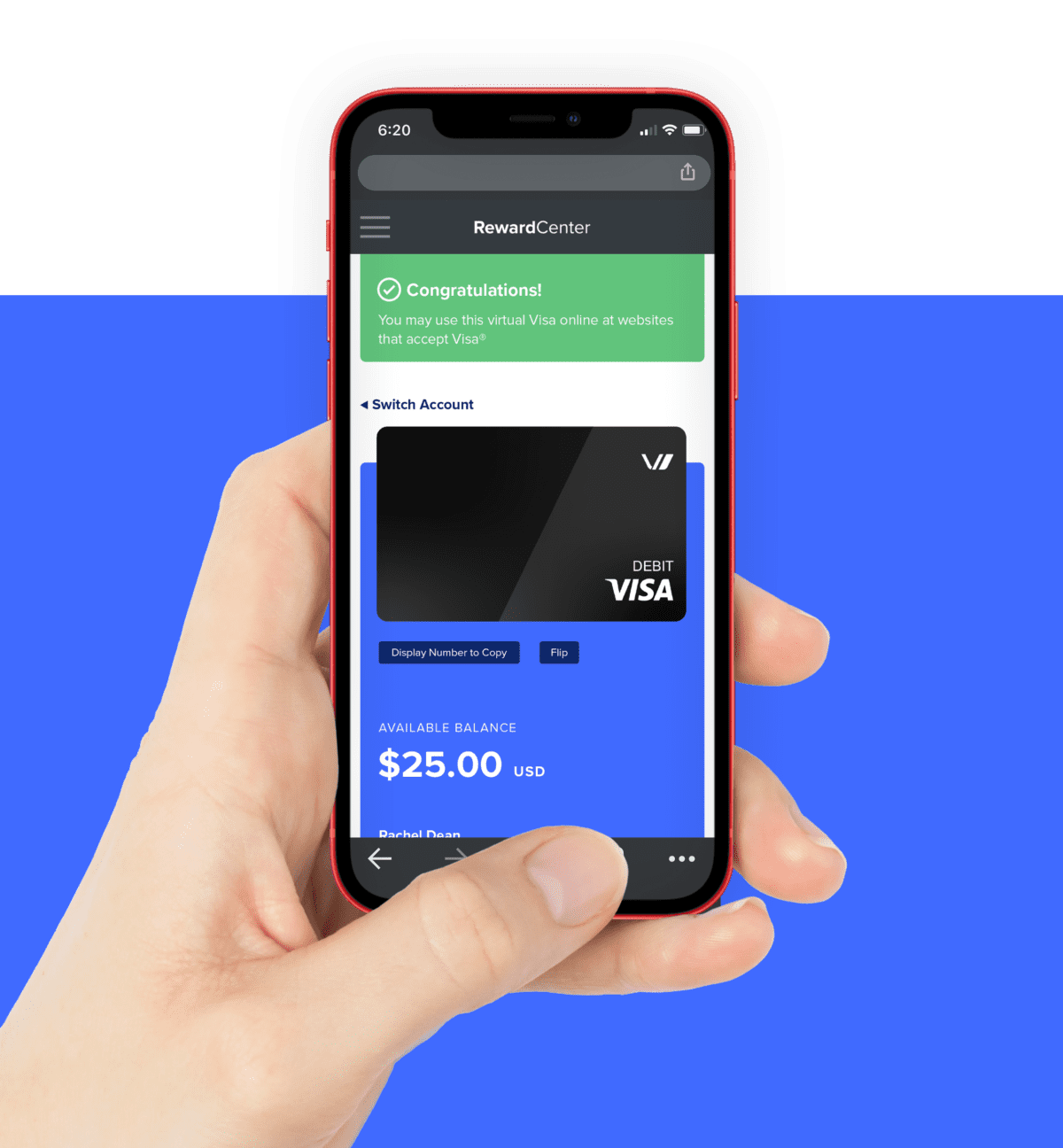

Ledger, inventor of Nano safe electronic purse – a number one technology cold handbag – have teamed with London area-based FinTech Baanx Class to help make a visa debit card that allows pages to spend new crypto held on their Nano purses.

They will have a 30-go out screen to repay without desire. Very while it is nearly a guaranteed credit, it will operate in very similar means of a person direction.

The issue with this specific variety of collateralized financing can be seen when you look at the the new future of several most other crypto loan providers that offered head personal loans: Celsius and you will BlockFi. Celsius are insolvent and you can BlockFi scarcely escaped it, and both froze equity distributions because they experienced economic crises as the companies they’d lent billions out of dollars to defaulted that it month.

We have witnessed talk about some body buying a residential property that have cryptocurrency to own a bit, however, a separate declaration from financial monster Citi discovers you to definitely crypto-recognized mortgages have been putting on ground to own factors one to recommend money collateralized from the electronic possessions will receive a growing input the brand new wide financing field

If you find yourself BlockFi try bailed away and can even be gotten, Celsius is actually against Chapter 11, and crypto depositors do not have unique standing since the financial institutions into the a good personal bankruptcy liquidation. Rather than FDIC insurance policies, high losings is actually you’ll be able to.

These types of mortgage has numerous experts, beginning with a-twist on a single resource gains taxation topic you to crypto mortgage loans resolve.

From inside the temporary, bitcoin is known as an item, and all sorts of almost every other cryptocurrencies is actually arguably – and is hotly contended – both bonds or merchandise.

But anyway, if you offer cryptocurrency you are responsible for investment gains income tax – even if you sell via an excellent crypto debit cards to buy a cup of coffee. Besides the most tax burden, the records working in just determining the size of this new investment obtain and you will filing toward Internal revenue service make small-measure crypto spending difficult – at the least theoretically, because the question has not most developed away from an income tax direction. But it is enough of problematic that the Senate is consider good crypto regulation who would exclude orders as much as $2 hundred.

Although not, when you are getting towards the debit- or borrowing-credit spending, that is a limit easy to violation – food for a few which have wine perform surpass they in lots of towns.

But, the newest credit – that is signing up prospective profiles in order to an excellent waitlist – may also offer fund predicated on one crypto balance

Having a loan of a few form, whether a personal bank loan, revolving line of credit or shielded cards, you to definitely wouldn’t be difficulty if you don’t spend the money for monthly balance that have crypto. Plus next, twelve yearly financing progress profile tend to be easier than simply multiple or plenty.