Double-check for and you will delete any aside-of-time beneficiaries on the company-backed life insurance and you can 401(k) plan, particularly if you had been unmarried when you become your work. “And if there’s a major lifestyle alter, you ought to see the individuals beneficiary statements,” says Dee Lee, an authorized economic planner that have Harvard Economic Teachers. Your parents, siblings, if not a previous lover might still getting detailed unlike your child.

3rd Week

Which month, you should check your credit score and make use of all that purchasing pointers you’ve been meeting which will make an official funds.

Check out their borrowing.

Save your time and you may disappointment by repairing errors today, when your life is seemingly sane. That have a strong credit history is very important while a dad-to-end up being and you may possibly looking into huge instructions particularly a house otherwise an automobile in the near future. That have a top credit score can help you lock in the best interest speed towards a car loan or financial.

You can to purchase your credit file away from Equifax, Experian, otherwise Transunion. For legal reasons, they may charges only about $several to own a basic report. Become forewarned one obtaining a free credit check from less legitimate providers are an invitation in order to identity theft & fraud. Concurrently, restrict yourself to only one glance at annually-any further than that can hurt your ranking.

Crunch brand new amounts.

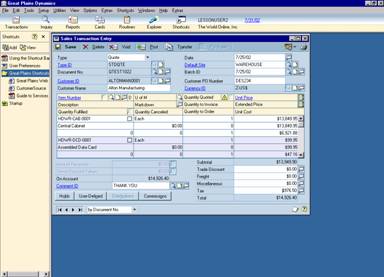

Now it’s time to acquire down to the past action off budget-and work out. Take-all the brand new numbers on expenses you may have tracked brand new prior month or two and place all of them from inside the a spreadsheet or finances record software (for those who haven’t currently). This will give you the full image of your existing expenses-one online installment loans Alabama which just give them a transformation to arrange to own little one.

Your goal is not to just break-even, however, to save cash daily, states Stephen Brobeck, exec movie director of your User Federation regarding The usa (CFA), a keen advocacy and you can training business for the Arizona, D.C. A 2019 survey because of the Bankrate discovered that one out of five working Us americans commonly rescuing any cash to possess old-age, an urgent situation loans, and other a lot of time-label economic requirements.

When creating the new budget, bear in mind your upcoming childrearing can cost you. Predicated on a great 2015 USDA declaration (the newest analysis offered), the common middle-earnings homes can get to blow about $step one,056 1 month to add a child that have axioms instance eating, gowns, security, transportation, and you will childcare. By using a long hop out regarding works (otherwise switch to region-date hours) it is possible to face the fresh economic double-whammy regarding covering this type of the fresh new costs towards a living which is suddenly less.

People which can’t seem to cut its solution to the recommended 10%-of-your-money draw may prefer to guide a consultation having an official economic coordinator, a pro taught to assist clients place economic goals. The fresh new Financial Considered Relationship demonstrates to you certification and you may charges on the the web site. Brand new CFA offers free consultation services together with other funds advice owing to the The usa Saves system.

Last Month

It is time to gauge the finances away from just how you’ll be able to pay for your child’s costs just after these are typically born, incase relevant, how long possible take off regarding performs.

Build a friend for the Time.

Get a full briefing regarding the pregnancy otherwise paternity advantages from individual info. Government legislation demands one to bring at the least 1 month observe when asking for time off beneath the Family relations and you can Scientific Leave Act, and therefore entitles any the fresh new father or mother who works for a company that have about 50 personnel when deciding to take doing 12 months from delinquent, seniority-secure get-off.

Your employer need to pay plain old part of their health care advantages on the stage. And people paid give you have, federal law along with entitles birth moms and dads to quick-label disability shell out (normally 6 to 8 months) in the event the its organization ordinarily will pay handicap professionals various other points.