HELOC mortgage to well worth (LTV) is actually a ratio loan providers use to look at how risky it is to provide to help you a homeowner having home financing. A house equity credit line is actually financing enabling being qualified individuals with active mortgages to get another loan due to their security. The fresh new LTV basis is employed in order to estimate your loan limit for every single date you get that.

The mortgage in order to worthy of ratio may also help determine new terms and conditions and you will conditions of one’s HELOC. Financial institutions, such as home loan financiers and you will banks, make use of newest domestic really worth and outstanding home loan so you can calculate the newest LVT to decide eligibility. Keep reading to understand more about HELOC LTVs and their conditions and exactly how an effective RenoFi HELOC differs.

A description from HELOC Financing to help you Well worth (LTV)

This new LTV proportion is a dimension lenders include in home loan underwriting to evaluate house collateral in advance of giving a HELOC mortgage. Creditors additionally use it to choose rates of interest and borrowing capacity.

If you have got numerous family guarantee lines of credit, financial institutions also can utilize the collective LTV to check your maximum. Banking institutions utilize the financing-to-worth metric so you’re able to sometimes approve otherwise refute your a moment home loan mortgage. People who have a top LTV rating higher interest levels as loan providers believe the finance alot more risky.

RenoFi Money and you will Mortgage so you’re able to Worth (LTV)

If you’re a vintage 90% LTV HELOC may sound instance a viable substitute for money an excellent household recovery opportunity, it often can not work just like the available security is not enough to deal with your entire wishlist. One method to resolve for this should be to make up the new Just after Repair Value of your residence and make use of one in order to increase the available collateral – here’s what RenoFi finance carry out.

Such as for instance, believe you reside currently respected during the $five-hundred,000, plus the home loan balance is $400,000. You’re planning a repair and predict your after repair worth of your home would-be whenever $640,000. Your current financing-to-really worth proportion (LTV) was at 80%, and thus you effectively can’t use almost anything to finance their recovery.

A great RenoFi loan, not, would allow one wade as high as 150% LTV otherwise 90% LTV utilising the after reple, while using the a simple family collateral financing causes the borrowing strength are $0, good RenoFi financing makes you acquire up to $176,000, thanks to the just after recovery value of your residence!

If you are considering property renovation and want a beneficial HELOC one to will provide you with better borrowing from the bank electricity, investigating RenoFi’s choice may be the best solution to you.

Formula from HELOC Mortgage so you can Value Proportion

Understanding how so you can determine the brand new LTV is vital since it facilitate you are aware their qualifications when applying for a HELOC. Listed here are essential strategies for figuring that loan-to-worthy of ratio.

Assets Assessment

Just like the computation requires the current property value, it is essential to features an exact assessment of your property. If you do not discover your own home’s newest worthy of, get a keen appraiser, ideally away from a home loan team, to check on your home.

Appraisers or family surveyors think multiple items when evaluating a property, such area, close business, assets dimensions, and you may one popular flat or family has.

If your house is old plus an out-of-the-method set, its well worth would be low. Brand new appraiser provides you with the present day house really worth immediately after evaluating they to equivalent characteristics and belongings around you.

There are also out your property’s really worth of the entering your own street address on the Trulia, Zillow, or Real estate agent, internet sites that provide estimated viewpoints to possess house in numerous metropolitan areas.

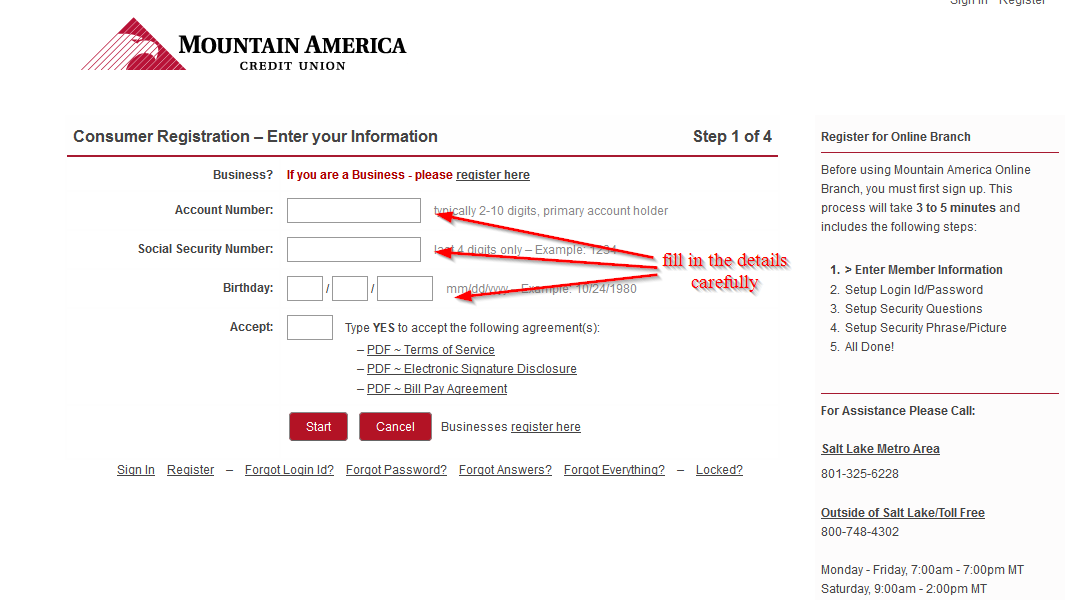

Get Financial Balance

An alternate shape need is the equilibrium kept in your financial. You are able to get this to figure from the getting in touch with the mortgage company or bank and you can asking for the bill. There are also loan places Montevallo it figure on the latest financial declaration or throughout your lender’s online commission portal. Furthermore highly better to Tend to be your house collateral fund during the it phase.