Thomas J Catalano is an excellent CFP and you will Inserted Investment Adviser that have the state of Sc, in which the guy released his personal monetary consultative agency during the 2018. Thomas’ experience brings him knowledge of a number of section in addition to investment, old-age, insurance, and you may monetary planning.

What exactly is Origination?

Origination is the multi-step procedure that every person have to go through to track down an effective financial or mortgage. The definition of in addition to pertains to other types of amortized unsecured loans. Origination is frequently a lengthy process that is tracked of the Government Put Insurance rates Corporation (FDIC) to have compliance that have Label XIV of one’s Dodd-Frank Wall Road Reform and Consumer Safeguards Operate. A loan origination percentage, always from the step one% of one’s loan, is intended to make up the lending company into functions involved in the process.

Secret Takeaways

- Brand new origination techniques usually pertains to lots of steps that is checked by FDIC.

- Pre-certification ‘s the first faltering step of the origination process which is whenever that loan manager get all the very first studies and you may advice linked so you’re able to income and the possessions at issue.

- All the documentation and you can files is after that tell you an automatic underwriting program to own loan acceptance.

Just how Origination Really works

Financing assist people and people meet the monetary requirements and you can obligations. They are regularly make large sales, pay off debt, commit, or purchase functions particularly land. In order to be accepted, the new borrower need certainly to make an application for financial support.

Borrowers need to submit various types of monetary guidance and you can documents in order to the lending company or other financial in the origination techniques. Several of the most prominent kind of advice and you will documents required include:

- Taxation statements

- Commission record

- Charge card pointers

- Financial comments and you may balance

Lenders next utilize this guidance to search for the sorts of loan therefore the interest rate in which the debtor is approved. Loan providers along with have confidence in additional information, especially the borrower’s credit report, to determine financing qualification.

It isn’t uncommon getting loan providers from the U.S. to fees origination costs. Talking about upfront charges you to definitely borrowers must spend the money for bank because the payment into the application, underwriting, and you can recognition process. Typically ranging anywhere between 0.5% to just one% of one’s financing well worth, the newest origination commission would be deducted from or set in the latest financing harmony.

Origination includes pre-certification of the borrower, together with underwriting, and you may lenders normally charge an origination payment to cover the associated will cost you.

Origination Tips and needs

Pre-degree ‘s the first step of your techniques. The mortgage manager suits for the debtor and you will obtains most of the very first investigation and you may recommendations according to money while the assets that financing is meant to protection.

Thus far, the lending company identifies the sort of mortgage whereby anyone qualifies, eg a personal loan. Fixed-price financing have a continuous interest for your life of loan, if you’re variable-price mortgage loans (ARMs) have an interest price you to definitely varies with regards to a list otherwise a bond speed, like Treasury ties. Crossbreed fund feature attract-price regions of both fixed and you may varying funds. They most often start off with a predetermined speed and in the end transfer to help you a supply.

The latest borrower gets a list of guidance must complete the loan application in this phase. That it thorough required documentation generally speaking has the acquisition and you will selling package, W-2 forms, profit-and-loss statements off folks who are notice-working, and you can lender statements. It is going to is home loan comments in the event your financing would be to refinance an existing mortgage.

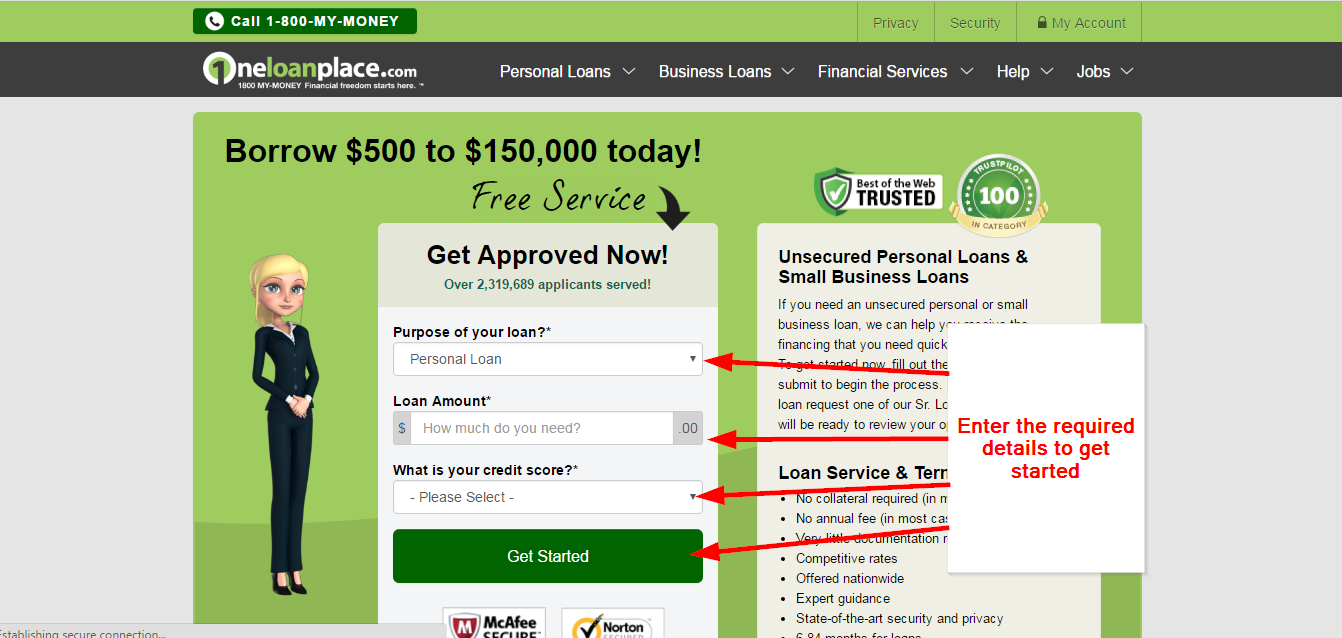

The borrower https://paydayloanalabama.com/choccolocco/ fulfills out a loan application and submits all of the requisite papers. The loan administrator next completes brand new legitimately necessary documents to help you procedure the loan.