Do you want examining the possibility paying off their mortgage early? We’ve waiting a couple of methods to make it easier to pay your residence loan faster.

Why you need to pay-off your residence financing shorter?

Possessing a home is a significant milestone, but the much time-label union regarding a loan are going to be overwhelming. You might potentially beat years’ property value loans if you are paying also some extra into the month-to-month bond – regarding go out you to otherwise as soon as possible. A few of the certain benefits to paying down your home loan more readily tend to be:

an effective. Rescuing for the appeal

Causing your own lowest mortgage payment means that you save significantly to the attention payments. Particularly, when you yourself have an enthusiastic R1,five hundred,000 thread more than twenty years, from the finest financing rate off %, paying your loan in just fifteen years could save you about R684, in interest will set you back*. Which bucks are led on after that expenditures or simply to the enhancing your total monetary cover during the later years.

b. Releasing on your own out-of loans

Imagine the comfort that accompany being bond-100 % free. As well as efficiently expenses reduced focus, paying your house loan in advance gives you a whole lot more monetary freedom. With no weight of your property loan, you need brand new freed-right up money some other investment, old-age discounts otherwise personal appeal (instance from there entrepreneurial dream of opening your own Lso are/Maximum Work environment, perhaps?).

c. Increasing your guarantee

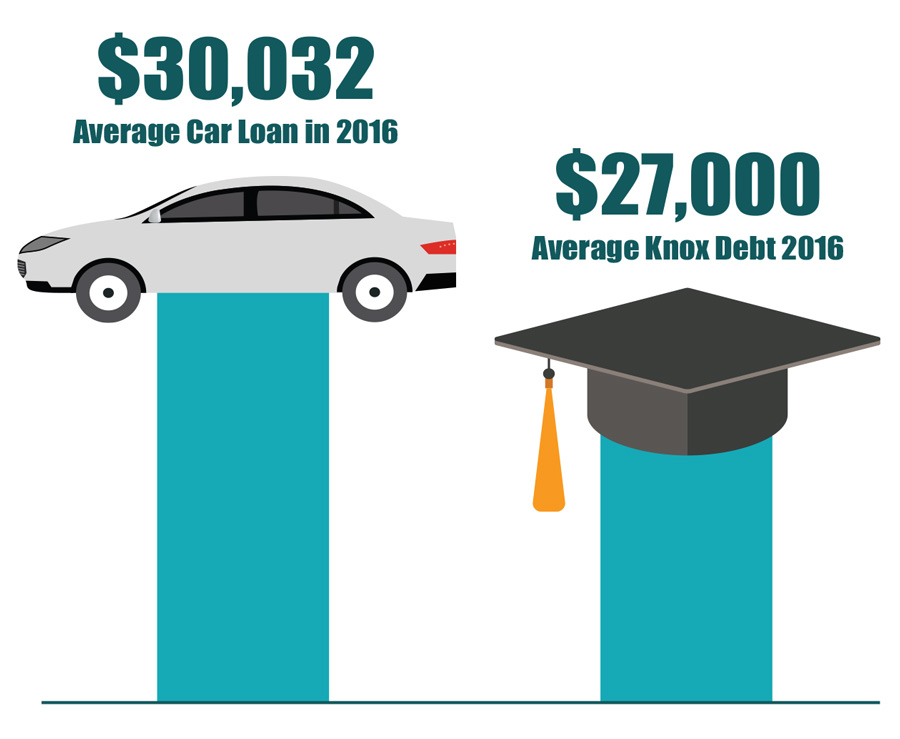

When you yourself have an accessibility bond, settling your property mortgage easily happens give-in-give with strengthening your guarantee throughout the assets and you will strengthening your budget. This increased West Virginia personal loans security is a secured asset that will bring a beneficial good foundation to own upcoming possibilities, for example home improvements, or a lower-interest replacement for car loan.

Tips for settling your home mortgage reduced

Claiming goodbye to help you financial obligation and achieving economic versatility is easier whenever you have got fundamental procedures as you are able to simply take today. Regardless of if every one of these steps will bring you closer to becoming able to bid farewell to your house financing prior to schedule, always demand financial specialists to be able to personalize this type of ideas to your specific factors:

Hold the best interest speed Begin your property-buying journey by securing the quintessential favorable rate of interest close to the start. Lookup and you will evaluate lenders’ costs to make sure you have the best bargain on the home loan, which will surely help you towards the early settlement. Using a bond creator such as BetterBond seems to simply help customers receive the very best package to their financial. They’ll rating prices off all of the biggest finance companies in your behalf, saving you time and money.

Existence overhaul Carefully examine your using patterns to understand the best places to reduce. Search carefully at your discretionary investing: dining out, entertainment memberships, and impulse hunting. By making smartly chosen options and you can prioritising debt goals, you might reroute men and women savings for the bond fees and relieve your property loan.

Turn the rubbish toward somebody else’s value Accept their internal conservative and declutter to totally free your house from unnecessary products that are event dirt. You should never put all of them away, instead mention on the web industries and you will/otherwise promote them through regional thrift communities to transform your own former gifts on the cash that one may add to their thread installment.

All the absolutely nothing extra assists Every short, additional sum makes a difference. As much as possible, shoot your own month-to-month payments with an additional dosage of commitment – although whatever you are able to afford try a supplementary R50 it times. These types of extra quantity make it possible to incrementally chip away at the prominent loans, decreasing the term on your financial and you can enabling you to save very well attract charge.