Can i discover money back within closure away from a beneficial Va home financing ? This can be possibly the very requested concern we discover out-of basic-go out homebuyers, as well as valid reason. Will eventually or another, we all must browse the oceans regarding monetaray hardship. Cash-right back mortgage loans is funds that enable the buyer to find an excellent house without a down-payment, or that allow you to bring equity out of your current domestic in the form of bucks to own discretionary usage. Enticing to own apparent grounds, it’s very important to understand the pros and drawbacks of money-straight back mortgage loans.

Whether this is your very first otherwise tenth house, quick cash-in-hands is a great idea while searching for instantaneous currency

- A lump sum payment of cash is offered which you can use you select fit. Web browser paying off personal debt, and then make renovations or funding educational activities,

- As much as possible lower your interest rate, an earnings-away re-finance is generally a win-profit disease

- Cash-out refinancing is easy to be eligible for once the house has already been holder-filled

- Interest rates are all the way down towards the dollars-aside refinance fund

- If your cash-away is employed to repay financial obligation having low-tax-deductible appeal, there may be income tax benefits for the money-aside refinancing

Whether or not it’s your earliest otherwise tenth house, easy money-in-give is a good idea when you’re looking for instant money

- Whether your household decrease inside the worth, and also you want to sell you could be in the major financial issues

- Cash-out could cause improved closing costs

- If you’re unable to re-finance to help you a lowered interest money back may possibly not be beneficial

Over cash return into a good Va mortgage, the solution is both yes and no. Among the numerous professionals provided by the newest Va financing ‘s the zero deposit requirement. easy personal loan Past one, per brand new Va Lender’s Handbook Bucks into the seasoned off financing proceeds is permissible only for certain types of refinancing money and around very limited things… With other sort of refinancing loans and all order/buy financing, cash-aside is not permissible. In the example of IRRRL /Streamline refinancing fund, consumers are only allowed cash back significantly less than one circumstance once they are given a refund toward price of energy efficient improvements. That it compensation would be as much as $6,000, plus the advancements need become produced inside 3 months from closing.

The newest Virtual assistant is extremely certain regarding the allowance of money straight back toward fund they ensures, this type of rules try unwavering and no conditions can be found. This situations that enable to possess cashback are listed below:

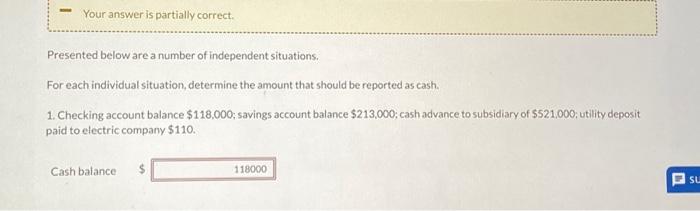

The usa Institution out-of Pros Points really does ensure it is a small sum of money right back to have a great Virtual assistant pick financing. How much cash gotten may possibly not be over the brand new capital sum your borrower keeps purchased your order. Such as, a borrower get found a reimbursement of the serious money deposit, appraisal payment and you will home review payment (when they possess purchased these plus the seller enjoys accessible to refund its payment). Fixes produced by the vendor, loans to own fixes and you may closure cost credits commonly sensed dollars right back.

The federal government insured FHA 203k financing will allow a homebuyer to help you acquire doing 97

Regardless of if, you to a house is within need of outrageous fix, a kind of rehab / structure financing grew to become offered. 5 % away from an excellent property’s coming (immediately following treatment) market value. The income need stay static in a keen escrow account and will be given out while the efforts are complete. Telephone call 888-573-4496 for more information.

Should your deal try a great refinance, cash-away are invited. Maximum an eligible debtor usually takes out try ninety % of appraised really worth. The fresh exemption is when the order is actually a good Va so you can Va loan the spot where the aim of new re-finance is for a lesser interest rate and lower percentage.

Next questions relating to Va fund and cash right back are replied of the Va Financial Facilities , e mail us from the 888-573-4496 .