When you are a veteran otherwise energetic-obligations provider associate trying to reach the desire homeownership inside Tx, Virtual assistant money shall be a good capital choice for your. Virtual assistant funds was regulators-backed loans created specifically to include sensible and you can available home loan options to the people who’ve supported otherwise are helping in the military. Let’s mention the pros and you can benefits associated with Virtual loans in Indian Field assistant loans from the context away from Colorado.

Advantages of Va Financing when you look at the Texas

- Zero Down payment: Among the many benefits of Virtual assistant loans is that they frequently need no down payment. This means you might funds to 100% of the home’s purchase price, and then make homeownership more obtainable, especially for earliest-time customers or individuals with limited funds having a down-payment.

- Aggressive Rates of interest: Virtual assistant money generally offer competitive interest rates, that lead to significant much time-name savings along side life of your own home loan. This type of advantageous cost, together with no private mortgage insurance rates (PMI) standards, helps make Virtual assistant finance an appealing choice as compared to conventional money.

- Flexible Borrowing Requirements: Va finance are known for its versatile borrowing conditions, making them even more accessible to people with less-than-best credit ratings. Whenever you are lenders can still imagine credit history, they frequently get a far more alternative approach, given situations such as your percentage history, financial balance, and you will capacity to pay the loan.

- Zero Prepayment Penalties: Virtual assistant funds dont demand one prepayment punishment. This means you could pay off the mortgage very early otherwise generate additional money versus running into any additional costs. That it autonomy allows you to save well on desire costs and you will probably pay your home loan reduced.

- Sleek Refinancing Selection: For folks who actually have a beneficial Va mortgage as they are seeking to refinance, the brand new Virtual assistant also offers streamlined refinancing solutions, including the Interest Avoidance Refinance loan (IRRRL). These software enable it to be simpler and pricing-energetic in order to refinance your existing Va financing locate best terms and conditions otherwise straight down interest levels.

Navigating the latest Virtual assistant Financing Procedure in Texas

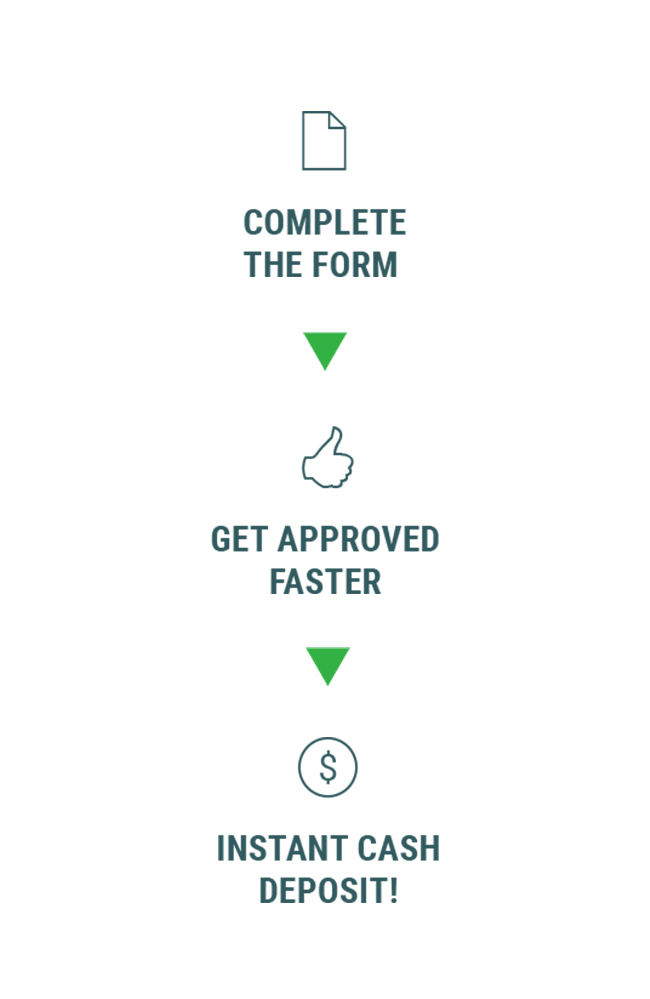

When deciding to take advantageous asset of the pros given by Va finance in Colorado, its necessary to pursue a few trick strategies:

- Determine Qualifications: Make certain your eligibility to possess an excellent Virtual assistant loan by the getting your Certificate out of Qualification (COE). This file confirms your entitlement to Virtual assistant financing benefits in fact it is generally obtained through the Agencies out-of Pros Things.

- Find a beneficial Va-accepted Financial: Manage a reliable lender proficient in Va loans just who understands the standards and processes involved. They’re able to guide you from app techniques, help acquiring the COE, that assist your browse the new Va mortgage criteria.

- Assemble Required Files: Prepare yourself the required records to suit your loan application, and evidence of army provider, earnings records, lender statements, and you may credit score. Your lender offers reveal selection of the mandatory documents.

- Rating Pre-approved: See pre-acceptance for your Virtual assistant loan before you begin your house browse. Pre-recognition not simply will give you a definite understanding of your financial budget in addition to strengthens your situation as a critical visitors when creating an offer to the a house.

Your way so you can Homeownership From inside the Texas

Virtual assistant money within the Tx provide a unique chance of experts and active-responsibility service participants to achieve homeownership. With advantages such as no down payment, aggressive rates of interest, and versatile borrowing from the bank requirements, Virtual assistant loans generate homeownership a great deal more available and you can affordable.

Va Fund Tx: What are the ideal where you should imagine?

With regards to making use of an excellent Virtual assistant loan inside the Tx, there are numerous great locations where provide attractive construction options and you can facilities. Here are a few of the greatest locations to consider playing with an effective Va loan into the Tx:

Think about, these are merely some situations, and there are many almost every other high places to take on playing with a Virtual assistant mortgage during the Colorado. It is important to explore more areas, consider your lifestyle choice, and you can speak with a realtor that is familiar with Virtual assistant funds and the regional housing industry for the best fit for your circumstances.

While happy to mention Va mortgage possibilities inside the Colorado otherwise have any questions about the brand new Va mortgage processes, dont hesitate to touch base. All of our faithful people regarding Virtual assistant loan pros has arrived to guide your every step of one’s means which help you achieve your own homeownership needs.