Remortgaging to discharge guarantee concerns using another type of home loan contract that allows people to view some of the collateral (the essential difference between the fresh property’s well worth in addition to a good home loan harmony) he has got collected inside their possessions over time. This process fundamentally relates to credit additional money up against the worth of the property, improving the measurements of the mortgage.

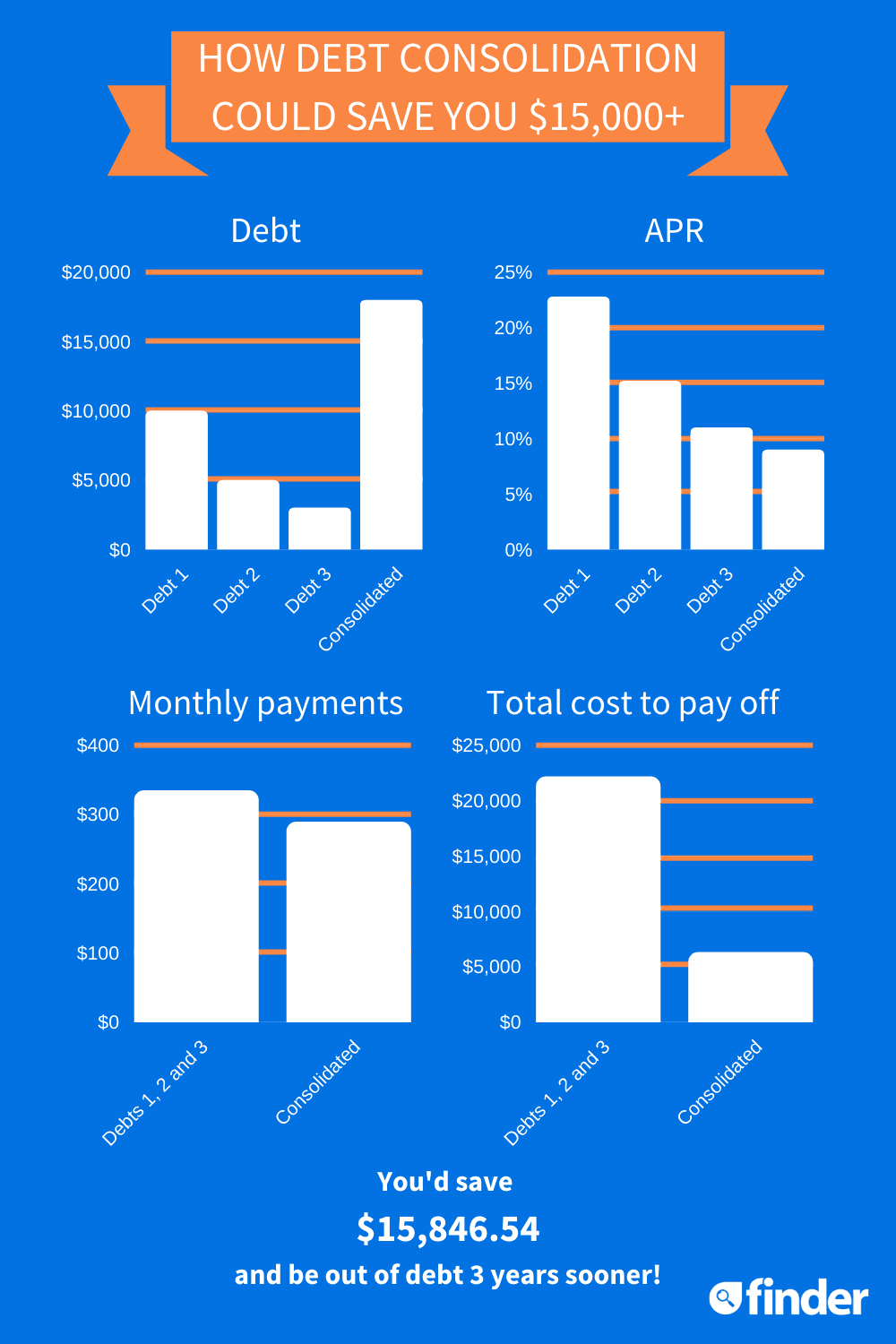

Property owners generally speaking always discharge guarantee a variety of intentions, such as for example home improvements, capital training will cost you, starting a business, otherwise consolidating large-notice bills into one, alot personal loans in Utah more manageable commission. By the remortgaging, they may be able secure a much bigger amount borrowed than simply its newest financial equilibrium, utilising the assets just like the equity.

The amount of collateral which is often create depends on circumstances including the property’s latest well worth, the latest the home loan balance, as well as the lender’s requirements. You will need to cautiously check out the will set you back involved, together with possible plan costs, valuation fees, and one very early cost costs about current home loan company, to evaluate whether or not remortgaging to release security are financially beneficial in the long run.

Creativity Fund

Creativity loans is a type of resource specifically geared to property builders to invest in structure or repair plans. Its built to safety the expense regarding the obtaining land, getting think permissions, and you can development functions to the domestic, industrial, otherwise blended-use buildings.

Development fund funds are usually planned that have flexible conditions one complement your panels schedule, tend to anywhere between months to a few decades. Such finance are used for soil-up improvements, conversions, refurbishments, otherwise assets renovations, bringing builders on required money first off and you can over build phase.

Interest levels having invention financing were greater than traditional mortgage loans due to the high threats in property invention. Loan providers assess the stability of the endeavor, the fresh developer’s background, and prospective earnings of your development whenever determining mortgage terminology.

Creativity finance plays a vital role throughout the property creativity industry by the helping developers to take care of challenging plans one to subscribe urban regeneration and you may satisfy housing and you will industrial space demands inside the expanding areas.

Industrial Mortgages

Industrial mortgages is fund created specifically for people and you may people to help you buy otherwise refinance industrial characteristics. Such features can include place of work buildings, shopping rooms, production facilities, and you can blended-play with developments.

In place of residential mortgage loans, which happen to be useful for property filled by the debtor, commercial mortgages are used for qualities intended for organization otherwise funding intentions. They often has prolonged terms than simply domestic mortgages, between 5 in order to 25 years, however it is you can to prepare brief industrial mortgages which have terms and conditions as the small as one 12 months.

However, commercial mortgage loans need increased put otherwise security contribution away from the newest borrower. Rates and you can terms are very different according to products including the borrower’s creditworthiness, the new property’s really worth and you will potential earnings, and you can prevailing economic climates.

A portion of the basis choosing if you are able to qualify for a connecting mortgage is if you have a sure-fire treatment for repay it inside the timeframe. Yet not, in many cases, a loan provider would want to rating a concept of your position and you may overall issues.

Safeguards

Bridging finance are usually secure against property, thus loan providers often assess the well worth and marketability of the property given as shelter.

Hop out Means

You really must have a clear want to pay the borrowed funds inside the decided-on name. This usually involves the product sales out of property otherwise refinancing to a financial.

Creditworthiness

Loan providers usually normally bring your credit score and you will complete financial predicament into account, however, this might be quicker stringent than having a mortgage app.

Purpose

You will have to offer an obvious and you may good reason having in need of the bridging mortgage, such as for example to buy another property otherwise capital household renovations.